Critical Illness Insurance Market survey report is very important in many ways to grow the business and thrive in the market. The market transformation highlighted here is taking place due to the movements of major players and brands such as developments, product launches, joint ventures, mergers, and allegations which in turn are changing the outlook of the global face of the Critical Illness Insurance Market industry. This is a professional and detailed report that focuses on primary and secondary drivers, market share, leading segments, and geographic analysis. The best Critical Illness Insurance Market Report is an important document in planning business goals or objectives.

Complicated market insights are transformed into simpler versions in the extensive Critical Illness Insurance Market report with the help of existing tools and techniques to provide them to the end users. The research study involved in this business report helps evaluate several important aspects that include but are not limited to investments in emerging markets, success of new products, and expansion of market share. The simplicity maintained in the research method and the use of excellent tools and techniques make the Critical Illness Insurance Market research report extraordinary. A number of estimates and calculations have been carried out in the market report assuming an exact base year and a historical year.

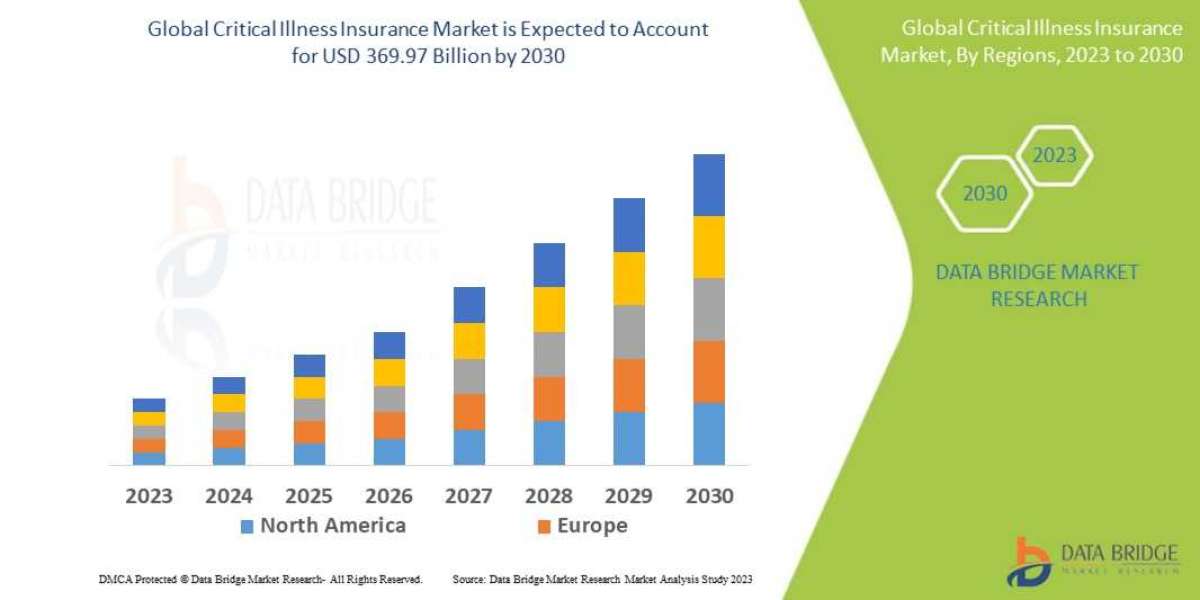

Data Bridge Market Research analyses that the critical illness insurance market, which was USD 216.5 Billion in 2022, would rocket up to USD 369.97 Billion by 2030 and is expected to undergo a CAGR of 10.40% during the forecast period.

Explore Further Details about This Research Critical Illness Insurance Market Report https://www.databridgemarketresearch.com/reports/global-critical-illness-insurance-market

Critical Illness Insurance Market Scope and Segmentation

REPORT METRIC | DETAILS |

Forecast Period | 2023 to 2030 |

Base Year | 2022 |

Historic Years | 2021 (Customizable to 2015-2020) |

Quantitative Units | Revenue in USD Million, Volumes in Units, Pricing in USD |

Segments Covered | By Product Type (Disease Insurance, Medical Insurance, and Income Protection Insurance), Application (Cancer, Heart Attack, and Stroke), |

Countries Covered | U.S., Canada, Mexico, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, South Africa, Saudi Arabia, UAE, Egypt, Israel, Rest of Middle East and Africa) |

Market Players Covered | AEGON Life Insurance Company Ltd( Netherlands), AXA Hong Kong(Hong Kong), Legal General Group plc(U.K.), Generali China Life Insurance Co. Ltd.(China), Prudential Hong Kong Limited(Hong Kong), Bajaj Allianz General Insurance Co. Ltd.(India), Tata AIG General Insurance Company Limited(India), United Healthcare Services Inc.(U.S.), Zurich American Insurance Company(U.S.) , AmMetLife Insurance Berhad (Malaysia), Star Union Dai-ichi Life Insurance Company Limited(India) , Sun Life Assurance Company of Canada.(Canada) , AFLAC INCORPORATED(U.S.) , Liberty General Insurance Ltd.(India) , HCF(Australia) , Star Union Dai-ichi Life Insurance Company Limited.(India) , Future Generali India Insurance Company Ltd.(India) , Religare Health Insurance Company Limited(India), Cigna(U.S.). Manulife Financial Corporation (Canada), Prudential Financial, Inc. (United States) |

Market Opportunities |

|

Market Definition

Critical illness is mainly associated with any illness, disease, or health condition which is a potential or immediate threat to life and needs comprehensive care and continuous monitoring, often in intensive care. Critical illness insurance is an insurance product which helps to check if an insurer is contracted to typically make payments if the policyholder is diagnosed with any kind of specific illnesses on a predetermined list as part of an insurance policy.

Global Critical Illness Insurance Market Dynamics

Drivers

- Increasing prevalence of critical illnesses

The rising incidence of critical illnesses such as cancer, heart disease, and stroke is a significant driver for the critical illness insurance market. As individuals become more aware of the financial burden associated with these illnesses, the demand for insurance coverage to mitigate the costs of treatment and recovery increases.

- Growing healthcare expenditure

The escalating costs of medical treatments and healthcare services have fuelled the demand for critical illness insurance. Individuals seek coverage that can provide financial support for expensive medical procedures, hospitalizations, medications, and post-treatment care.

- Advancements in medical technology and improved survival rates

Advances in medical technology and treatment protocols have led to improved survival rates for critical illnesses. As more individuals survive critical illnesses, the need for financial protection and support during recovery becomes crucial, driving the demand for critical illness insurance.

Opportunities

- Untapped markets and emerging economies

There are significant growth opportunities in untapped markets and emerging economies, where awareness and adoption of critical illness insurance are relatively low. As these markets evolve and healthcare awareness increases, the demand for insurance coverage against critical illnesses is expected to rise.

- Product innovation and customization:

Insurers have the opportunity to develop innovative and customized critical illness insurance products. By offering flexible coverage options, tailored packages, and additional benefits, insurers can cater to the diverse needs and preferences of individuals seeking critical illness coverage.

Key questions answered in the Critical Illness Insurance Market are:

- What is Critical Illness Insurance Market?

- What was the Critical Illness Insurance Market size in 2022?

- What are the different segments of the Critical Illness Insurance Market?

- What growth strategies are the players considering to increase their presence in Critical Illness Insurance Market?

- What are the upcoming industry applications and trends for the Critical Illness Insurance Market?

- What are the recent industry trends that can be implemented to generate additional revenue streams for the Critical Illness Insurance Market?

- What major challenges could the Critical Illness Insurance Market face in the future?

- What segments are covered in the Critical Illness Insurance Market?

- Who are the leading companies and what are their portfolios in Critical Illness Insurance Market?

- What segments are covered in the Critical Illness Insurance Market?

- Who are the key players in the Critical Illness Insurance Market?

Browse Related Reports:

Barth Syndrome Treatment Market Size | Statistics Report, Share, Forecast, Trends

Vegetable Concentrates Market Size, Share Trends Analysis Report

Steel Fiber Market Size and Forecasts, Share and Trends

Glow Discharge Mass Spectrometry Market Size, Industry Share, Forecast

Exterior Insulation Market | Size,Share, Growth

Chronic Idiopathic Constipation Treatment Market Size, Trends Growth Analysis

Industrial Utility Vehicle Market Market- Global Industry Analysis and Forecast

About Data Bridge Market Research:

US: +1 888 387 2818

UK: +44 208 089 1725

Hong Kong: +852 8192 7475

Email – corporatesales@databridgemarketresearch.com