Robotic Process Automation (RPA) in the insurance market refers to the application of software robots or 'bots' to automate repetitive, rule-based tasks traditionally performed by humans. This technology streamlines various processes within insurance companies, including claims processing, policy administration, underwriting, and customer service, leading to increased efficiency and cost savings. The global RPA in insurance market has seen significant growth, driven by the increasing demand for automation to enhance operational efficiency and reduce costs.

The RPA in the insurance market is poised for substantial growth, driven by the need for greater efficiency, cost reduction, and enhanced customer service. With advancements in AI and end-to-end automation, RPA solutions are becoming increasingly sophisticated, offering significant benefits to insurance companies. As the market continues to evolve, companies that effectively leverage RPA will be well-positioned to gain a competitive edge and achieve operational excellence.This capability significantly enhances the efficiency of fraud detection processes, allowing insurers to pinpoint fraudulent activities in real time or even before they occur.

Robotic Process Automation (RPA) is revolutionizing the insurance market by streamlining operations, enhancing customer experiences, and improving efficiency. In this dynamic sector, RPA offers significant advantages by automating repetitive tasks, reducing errors, and freeing up human resources for more strategic activities.In insurance, RPA is extensively used for back-office operations such as claims processing, policy administration, and underwriting. RPA bots can swiftly extract data from various sources, validate information, and update systems accurately, thus accelerating the entire process. This efficiency boosts productivity ensures compliance with regulations and reduces the risk of errors.Moreover, RPA facilitates seamless integration between disparate systems, enabling insurers to enhance their legacy infrastructure without undergoing costly and time-consuming overhauls. This interoperability allows for smoother data exchange and better collaboration across departments, leading to faster decision-making and improved customer service.Customer service is a critical aspect of the insurance industry, and RPA plays a pivotal role in enhancing it. Bots can handle routine inquiries, process policy renewals, and even assist with claims submissions, providing customers with quick and personalized assistance around the clock. By automating these tasks, insurers can offer a more responsive and efficient service while reducing operational costs.RPA integrates seamlessly into existing systems, automating repetitive tasks with speed and accuracy.

To Gain More Insights into The Analysis, Browse Sample Pages Of The Research Report

https://pristineintelligence.com/request-sample/rpa-in-insurance-market-216

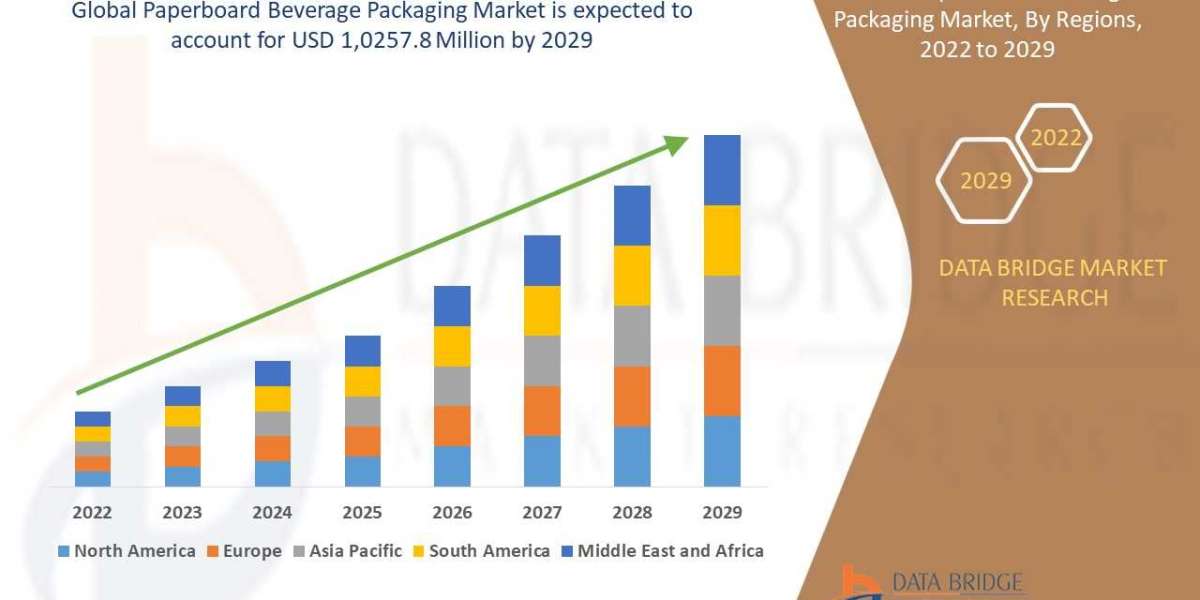

According to a new report published by Pristine Intelligence Research, titled, “Global RPA in the Insurance Market by Component, Deployment Mode, Enterprise Size and Application: Opportunity Analysis and Industry Forecast, 2024–2030,” The RPA in the Insurance market was worth USD 102.34 Million in 2023. As such, the forecast is that the market is expected to reach USD 410.85 Million by 2032 with a CAGR of 16.7% over the period from 2024 to 2032.

The latest report on the RPA in Insurance Market provides a detailed analysis of the market for the years 2024 to 2032. It presents a comprehensive overview of the global RPA in Insurance industry, incorporating all key industry trends, market dynamics, competitive landscape, and market analysis tools such as Porter's five forces analysis, Industry Value chain analysis, and PESTEL analysis of the RPA in Insurance Market. Moreover, the research covers crucial chapters such as Patent Analysis, Regulatory Framework, Technology Roadmap, BCG Matrix, Heat Map Analysis, Price Trend Analysis, and Investment Analysis which help to grasp the market direction and development in the present and forthcoming years.

Top Key Players Involved Are:

"UiPath (USA), Automation Anywhere (USA), Blue Prism (UK), Pegasystems (USA), Kryon (Israel), NICE (Israel), WorkFusion (USA), EdgeVerve Systems (India), Thoughtonomy (UK), Jacada (USA), AntWorks (Singapore), Softomotive (UK), Kofax (USA), BlackLine (USA), Redwood Software (Netherlands), HelpSystems (USA), OpenConnect (USA), Ephesoft (USA), Genpact (USA), ASG Technologies (USA) and Other Active Players."

Global RPA in the Insurance Market, Segmentation

The Global RPA in the Insurance market is segmented based on Component, Application, Deployment Mode, Organization Size, and End User.

Component:

Insurance companies face a myriad of tasks ranging from claims processing and policy management to underwriting and customer service. The Service segment of RPA caters precisely to these needs by offering tailored solutions designed to automate repetitive tasks, minimize errors, and accelerate response times. By leveraging RPA in the Service segment, insurers can achieve significant cost savings by reducing manual intervention, enhancing accuracy, and ensuring compliance with regulatory standards. Moreover, the scalability of RPA enables insurers to adapt to evolving market dynamics and effectively manage fluctuations in demand.

Deployment Mode:

Robotic Process Automation (RPA) within the insurance sector, the On-Premise deployment mode stands as a dominant force. This dominance is underpinned by several key factors that align closely with the specific needs and preferences of insurance companies. The nature of sensitive data handling and regulatory compliance in the insurance industry often necessitates stringent security measures. On-Premise deployment provides a greater sense of control and security as it allows organizations to directly manage and safeguard their data within their own infrastructure.

Region:

The North America's insurance industry is characterized by its large market size, diverse product offerings, and stringent regulatory requirements, all of which make it ripe for automation solutions. RPA technologies offer insurers the means to automate repetitive tasks, such as claims processing, underwriting, policy administration, and customer service inquiries, thereby reducing costs, minimizing errors, and accelerating time-to-market. Moreover, the increasing complexity of insurance products and the growing demand for personalized services necessitate advanced automation capabilities, which North American insurers are keen to adopt.

Global RPA in Insurance Market Segmented because of Component, Deployment Mode, Enterprise Size and Application. By Component, the market is categorized into Solution, Service. By Deployment Mode, the market is categorized into On-Premise, Cloud. By Enterprise Size, the market is categorized into Large Enterprise, Small and Medium-sized Enterprises.By Application, the market is categorized into Claims Processing, Insurance Underwriting, Regulatory Compliance, Finance and Accounts.By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East Africa (Saudi Arabia; South Africa, etc.).

Browse Sample Pages Of The Research Report

https://pristineintelligence.com/request-sample/rpa-in-insurance-market-216

Key Findings of the Study

- The implementation of Robotic Process Automation (RPA) in the insurance sector leads to significant cost savings by reducing manual intervention, minimizing errors, and streamlining processes. This efficiency enhancement allows insurers to handle tasks such as claims processing, policy management, underwriting, and customer service more swiftly and accurately.

- RPA deployment, especially in the On-Premise mode, provides insurance companies with greater control over sensitive data handling and ensures compliance with regulatory standards. By managing and safeguarding data within their own infrastructure, insurers can mitigate risks associated with data breaches and regulatory non-compliance.

About Us:

We are technocratic market research and consulting company that provides comprehensive and data-driven market insights. We hold the expertise in demand analysis and estimation of multidomain industries with encyclopedic competitive and landscape analysis. Also, our in-depth macro-economic analysis gives a bird's eye view of a market to our esteemed client. Our team at Pristine Intelligence focuses on result-oriented methodologies which are based on historic and present data to produce authentic foretelling about the industry. Pristine Intelligence's extensive studies help our clients to make righteous decisions that make a positive impact on their business. Our customer-oriented business model firmly follows satisfactory service through which our brand name is recognized in the market.

Contact Us:

Office No 101, Saudamini Commercial Complex,

Right Bhusari Colony,

Kothrud, Pune,

Maharashtra, India - 411038 (+1) 773 382 1049 +91 - 81800 - 96367

Email: sales@pristineintelligence.com