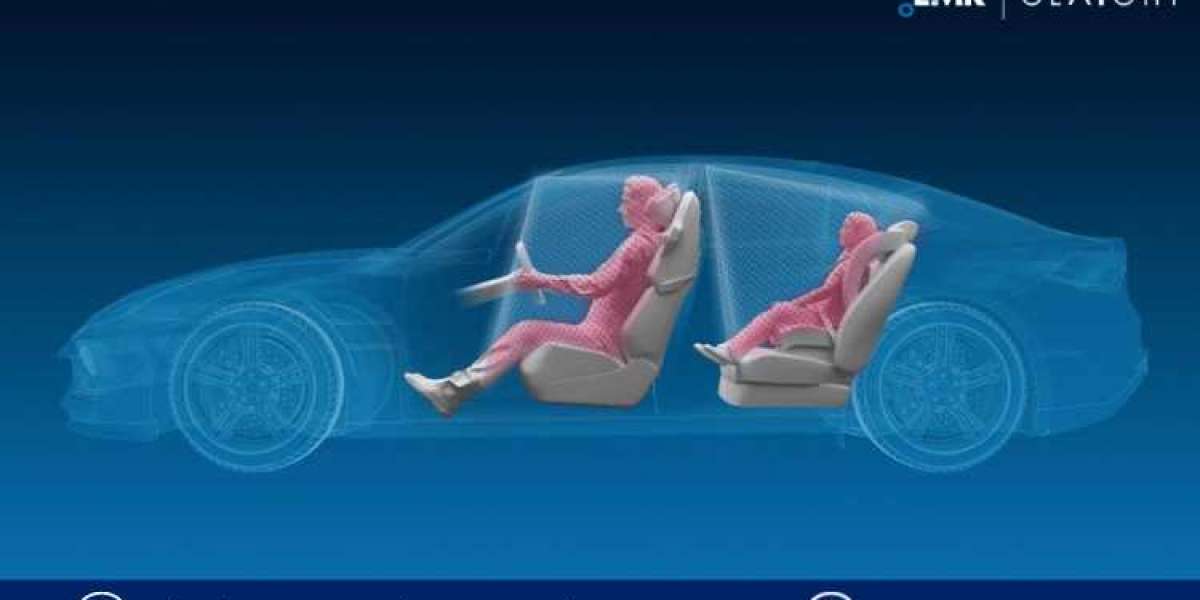

The automotive occupant sensing system market is driven by increasing safety regulations and demand for advanced safety features. These systems detect and classify occupants, enabling tailored safety measures like airbag deployment. Key players are investing in research to enhance accuracy and reliability. The market is poised for growth due to rising awareness of passenger safety and the integration of smart sensors in vehicles, particularly in regions with stringent safety norms like North America and Europe.

Automotive Occupant Sensing System Market Size and Growth

In 2023, the global automotive occupant sensing system market size reached approximately USD 2.08 billion. This growth is driven by increasing vehicle safety standards worldwide, prompting automakers to adopt advanced occupant sensing technologies. These systems detect and classify occupants in vehicles, enabling customized safety measures such as precise airbag deployment based on passenger characteristics. Factors such as rising consumer awareness about vehicle safety and regulatory mandates for occupant protection contribute significantly to market expansion.

Looking ahead, the market is projected to continue its upward trajectory with a compound annual growth rate (CAGR) of 6.9% from 2024 to 2032. By the end of this forecast period, around 2032, the market size is anticipated to expand to approximately USD 3.80 billion. This growth will be supported by ongoing technological advancements in sensor accuracy and reliability, as well as increasing integration of smart sensing systems in both conventional and electric vehicles. Regions like North America and Europe, known for stringent safety regulations and high vehicle adoption rates, are expected to remain key drivers of market growth during this period.

Automotive Occupant Sensing System Market Trends

Several trends are shaping the automotive occupant sensing system market:

Request Sample: https://www.expertmarketresearch.com/reports/automotive-occupant-sensing-system-market/requestsample

1. Advancements in Sensor Technology: Ongoing advancements in sensor technology, including ultrasonic, infrared, and pressure sensors, are enhancing the accuracy and reliability of occupant detection systems. These improvements enable more precise classification of occupants and contribute to enhanced safety measures.

2. Integration of AI and Machine Learning: Integration of artificial intelligence (AI) and machine learning algorithms allows occupant sensing systems to adapt and learn from real-world data, improving their ability to detect occupants accurately in various conditions and scenarios. This trend enhances system performance and reduces false alarms.

3. Focus on Multi-Modal Sensing: Automotive manufacturers are increasingly adopting multi-modal sensing approaches, combining different sensor types such as cameras, radar, and LiDAR, to achieve comprehensive occupant detection capabilities. This approach enhances system robustness and enables better detection in challenging environments.

4. Rise of Interior Monitoring Systems: Interior monitoring systems, which include occupant sensing functionalities along with features like driver monitoring and cabin environment monitoring, are gaining traction. These systems enhance both safety and comfort by detecting occupants' behavior, posture, and vital signs to provide tailored safety alerts and improve overall driving experience.

5. Regulatory Mandates and Safety Standards: Stringent safety regulations and standards imposed by governments and automotive safety organizations are driving the adoption of occupant sensing systems. Compliance with these regulations incentivizes automakers to integrate advanced safety features, including occupant detection systems, into their vehicles.

6. Growing Demand for Autonomous Vehicles: The rise of autonomous vehicles is driving the demand for advanced occupant sensing systems. These systems play a crucial role in enabling safe and efficient autonomous driving by ensuring the accurate detection and monitoring of occupants for enhanced safety and comfort.

Market Opportunities and Challenges

Opportunities:

1. Rising Demand for Safety Features: The increasing emphasis on vehicle safety, coupled with stringent regulatory mandates, presents a significant opportunity for occupant sensing system providers. As consumers prioritize safety features in their vehicles, there's a growing demand for advanced occupant detection technologies.

2. Integration with Autonomous Driving: The proliferation of autonomous driving technology creates opportunities for occupant sensing systems. These systems play a crucial role in ensuring the safety of occupants in autonomous vehicles by accurately detecting and monitoring occupants' presence, posture, and behavior.

3. Expansion in Emerging Markets: Emerging markets, particularly in Asia-Pacific and Latin America, present untapped opportunities for occupant sensing system manufacturers. As these regions experience rapid economic growth and increasing vehicle sales, there's a growing demand for advanced safety features, including occupant detection systems.

4. Technological Advancements: Continued advancements in sensor technology, artificial intelligence, and machine learning offer opportunities to enhance the performance and capabilities of occupant sensing systems. Innovations in sensor fusion and data processing algorithms can improve accuracy, reliability, and robustness, further driving market growth.

Challenges:

1. Cost Constraints: The cost of advanced occupant sensing systems remains a significant challenge, particularly for mass-market vehicles. Balancing the integration of advanced features with cost-effectiveness poses a challenge for automakers and suppliers, especially in price-sensitive segments.

2. Complexity and Integration: Integrating occupant sensing systems into vehicles involves complex engineering challenges, including system integration, calibration, and validation. Ensuring seamless integration with other vehicle components and systems while maintaining reliability and performance adds complexity to the development process.

3. Data Privacy and Security Concerns: Occupant sensing systems that collect and process sensitive occupant data raise concerns about privacy and security. Ensuring the protection of personal data and compliance with data privacy regulations poses challenges for automakers and suppliers, requiring robust data security measures and transparent data handling practices.

4. Environmental Factors: Environmental conditions such as extreme temperatures, humidity, and vibrations can impact the performance and reliability of occupant sensing systems. Ensuring robustness and durability under various environmental conditions requires rigorous testing and validation processes, adding complexity and cost to development efforts.

Market Dynamics

The automotive occupant sensing system market is influenced by various dynamic factors:

1. Regulatory Landscape: Stringent safety regulations and standards imposed by governments worldwide are driving the adoption of occupant sensing systems. Compliance with these regulations incentivizes automakers to integrate advanced safety features into their vehicles, boosting market growth.

2. Technological Advancements: Continuous advancements in sensor technology, artificial intelligence, and machine learning are reshaping occupant sensing systems. Innovations in sensor fusion, data processing algorithms, and multi-modal sensing enhance system accuracy, reliability, and robustness, driving market evolution.

3. Consumer Demand: Increasing consumer awareness and demand for vehicle safety features, coupled with a growing preference for advanced driver-assistance systems (ADAS), are fueling market growth. Consumers prioritize occupant sensing systems for their ability to enhance passenger safety and provide personalized protection measures.

4. Integration with Autonomous Driving: The rise of autonomous driving technology presents new opportunities for occupant sensing systems. These systems play a crucial role in ensuring the safety of occupants in autonomous vehicles by accurately detecting and monitoring occupants' presence, posture, and behavior.

5. Cost and Affordability: Cost constraints pose challenges for widespread adoption of occupant sensing systems, particularly in mass-market vehicles. Balancing the integration of advanced features with cost-effectiveness is essential for automakers and suppliers to ensure market competitiveness and profitability.

6. Supply Chain Dynamics: The automotive supply chain landscape influences the availability and affordability of components required for occupant sensing systems. Collaboration among automotive OEMs, suppliers, and technology partners is crucial for driving innovation, reducing production costs, and ensuring supply chain resilience.

7. Competitive Landscape: Intense competition among occupant sensing system providers drives continuous innovation and product development. Market players focus on enhancing product performance, reliability, and functionality to gain a competitive edge and capture a larger market share.

8. Environmental and Economic Factors: Environmental considerations, such as sustainability and energy efficiency, influence the design and development of occupant sensing systems. Economic factors, including fluctuating raw material prices and currency exchange rates, also impact market dynamics and profitability.

Competitive Landscape

The key players in the industry includes:

- Continental AG

- ZF Friedrichshafen AG

- Lear Corporation

- Autoliv Inc.

- DENSO Corporation

- Vayyar Imaging Ltd.

- Robert Bosch GmbH.

- Joyson Safety Systems Aschaffenburg GmbH

- Texas Instruments Incorporated

- Flexpoint Sensor Systems, Inc.

- LeddarTech Inc.

- Valeo

- Others

Media Contact

Company Name: Claight Corporation

Contact Person: John Walker, Corporate Sales Specialist – U.S.A.

Email: sales@expertmarketresearch.com

Toll Free Number: +1-415-325-5166 | +44-702-402-5790

Address: 30 North Gould Street, Sheridan, WY 82801, USA

Website: https://www.expertmarketresearch.com

Aus Site: https://www.expertmarketresearch.com.au