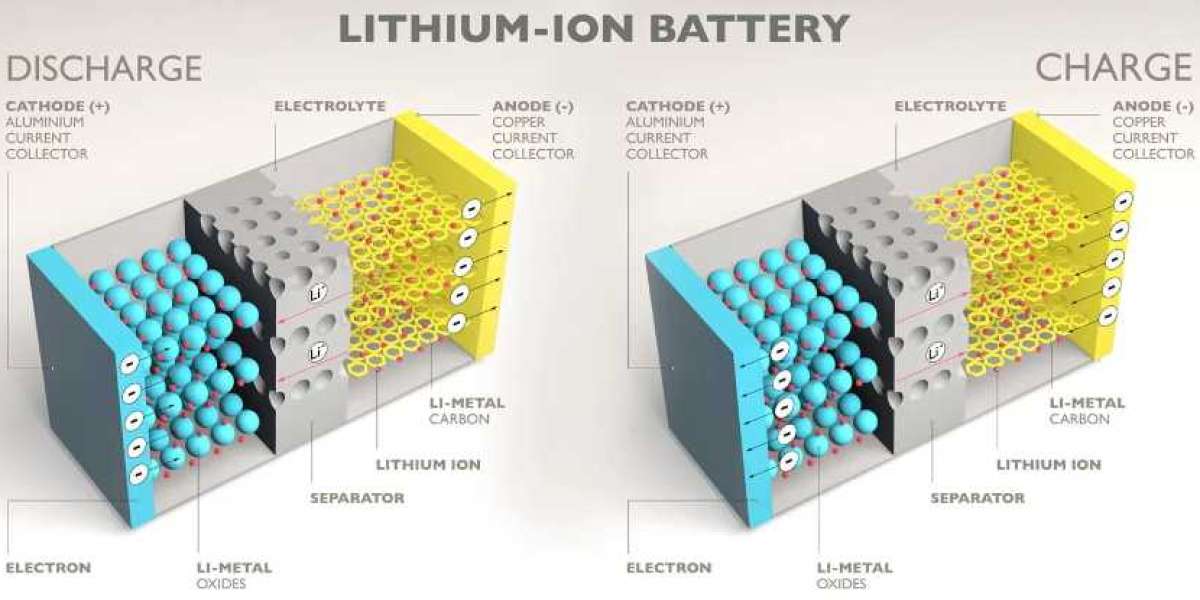

The lithium-ion battery anode market is witnessing robust growth driven by the escalating demand for rechargeable batteries in various sectors such as consumer electronics, automotive, and energy storage. As the primary component responsible for storing and releasing lithium ions during charge and discharge cycles, anodes play a crucial role in determining the performance and efficiency of lithium-ion batteries.

The global Lithium-Ion Battery Anode Market is projected to grow from USD 12.0 billion in 2023 to USD 46.5 billion by 2028, at a CAGR of 31.2% during the forecast period.

Key factors fueling the Lithium-Ion Battery Anode market growth include the expanding consumer electronics market, increasing adoption of electric vehicles (EVs), and growing investments in renewable energy storage systems. The proliferation of smartphones, laptops, tablets, and wearable devices has led to a surge in the demand for lithium-ion batteries, consequently driving the demand for high-performance anode materials.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=147095907

In the automotive sector, the transition towards electric mobility is accelerating the adoption of lithium-ion batteries, creating significant opportunities for anode manufacturers. Governments worldwide are implementing stringent regulations to curb greenhouse gas emissions, leading automakers to invest heavily in electric and hybrid vehicles. This trend is expected to further boost the demand for lithium-ion battery anodes in the coming years.

Moreover, the renewable energy sector is witnessing rapid growth, with an increasing emphasis on energy storage solutions to address intermittency issues associated with renewable power sources. Lithium-ion batteries are emerging as a preferred choice for energy storage applications due to their high energy density, long cycle life, and fast charging capabilities.

Technological advancements and innovations in anode materials are also driving market growth. Researchers and manufacturers are focusing on developing advanced anode materials with improved energy density, enhanced stability, and faster charging rates. Silicon-based anodes, in particular, hold promise for significantly increasing the energy density of lithium-ion batteries, thereby attracting considerable investment and research interest.

Despite the promising growth prospects, the lithium-ion battery anode market faces challenges such as supply chain disruptions, fluctuating raw material prices, and concerns regarding battery safety and performance. However, ongoing research and development initiatives aimed at addressing these challenges are expected to drive innovation and propel market growth in the forecast period.

Get Sample Copy of this Report: https://www.marketsandmarkets.com/requestsampleNew.asp?id=147095907

Lithium-Ion Battery Anode Market Key Players

Companies such as Ningbo Shanshan Co., Ltd. (China), Jiangxi Zhengtuo New Energy Technology (China), Resonac Holdings Corporation (Japan), POSCO FUTURE M (South Korea), Mitsubishi Chemical Group Corporation (Japan), and SGL Carbon (Germany) fall under the winners’ category. These are leading players in the lithium-ion battery anode market globally. These players have adopted the strategies of acquisitions, partnerships, expansions, and investments to increase their market shares.

Ningbo Shanshan Co., Ltd. (China)

Ningbo Shanshan Co., Ltd. is engaged in the RD, production, and sales of lithium battery materials, including cathode materials, anode materials and electrolytes. The company offers a wide range of products, including polarizers, lithium cobalt oxide, lithium nickel cobalt manganate, lithium nickel cobalt aluminate, lithium manganate, electrolytes, lithium hexafluorophosphate, lithium salts, and various anode materials such as artificial graphite, natural graphite, and silicon-based anodes.

Ningbo Shanshan Co., Ltd. has a significant presence in China, with operations extending to regions like Ningbo, Shanghai, Changsha, Ningxia, and Dongguan. The company caters to a diverse range of industries, including electronics, energy storage, electric vehicles, and new energy technologies. By providing essential materials for lithium batteries and polarizers.

The company operates through five business segments, namely shanjin polarizer segment, lithium battery material segment, new energy vehicle segment, energy management segment, and others. Specifically, the company offers anode materials under the lithium battery material segment, which includes artificial graphite, natural graphite, and silicon-based anodes.

Speak to Expert: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=147095907

Recent Developments

- In January 2024, Ningbo Shanshan Technology Co., Ltd., a leading company in the production of synthetic graphite anode materials for lithium-ion batteries has expanded the establishment of a new production facility 300,000-ton anode integrated project in Yunnan, China.

- In June 2023, Resonac Holdings Corporation acquired 100% shares in AMl Automation. The acquisition is set to significantly benefit Resonade graphite electrodes by expanding its offerings to include total solution services for Electric Arc Furnaces (EAF). By integrating AMI's digital automation and optimization solutions, Resonac aims to meet the growing demand for graphite electrodes, particularly in new EAF projects globally.

- In September 2023, Ningbo Shanshan has a longstanding relationship with LG Energy Solution (LGES), particularly in the field of anode materials and polarizers. Over the past decade, they have collaborated successfully, leading to significant achievements in the development and industrialization of anode materials. Ningbo Shanshan emphasized their commitment to focusing on anode materials and polarizers, aiming to strengthen their bond with LGES to meet localization demands.

Lithium-Ion Battery Anode Market Segments

Based on Materials

- Active Anode Materials

- Natural Graphite

- Synthetic Graphite

- Silicon

- Li-Compounds Metal

- Anode Binders

The synthetic graphite of lithium-ion battery anode market, by materials, is expected to be the largest market from 2023 to 2028.

While boasting superior purity (99%) and uniformity compared to its natural counterpart, synthetic graphite, derived from pitch and coke, comes at a premium – three to four times the cost. Despite the price difference, its well-defined structure facilitates smoother lithium-ion movement, enabling faster charging and higher reliability. These performance advantages make synthetic graphite the preferred choice for specialty applications within the lithium-ion battery anode market, even during the forecast period.

Based on Battery Product

- Cell

- Battery Pack

Based on End-Use

- Automotive

- Non-Automotive

- Energy Storage

- Aerospace

- Marine

- Others

Get 10% Customization on this Report: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=147095907

The automotive end-use segment is accounted for the largest share in the global lithium-ion battery anode market during the forecast period.

The automotive sector is a key end-use for the lithium-ion battery anode market. This is due to the rising popularity of electric vehicles (EVs), e-bikes, and automated guided vehicles (AGVs) – all of which rely heavily on lithium-ion batteries. As competition in the EV market heats up, manufacturers are constantly striving for better battery performance. This focus on operational excellence translates to a growing demand for lithium-ion batteries, and consequently, their core component – the anode.

Based on Region

- Asia Pacific

- Europe

- North America

Europe lithium-ion battery anode market is projected to grow at the second largest

Europe stands out as the world's number two consumer of lithium-ion battery anodes by value. This robust market is fueled by the growing demand for electric vehicles (EVs) within the region. Government incentives and funding play a crucial role in promoting EV adoption, which in turn, translates to a significant need for lithium-ion batteries and their key component, the anode. This focus on clean and sustainable transportation solutions positions Europe as a major player in the lithium-ion battery anode market.