"16. Being a reliable source of market research information, Europe Digital Payment Market reports expand the reach of business success. This market analysis provides knowledge about various segments that are relied upon to observe the fastest business development within the framework of forecast estimates. By thinking from the end user's point of view, a team of researchers, forecasters, analysts and industry experts worked meticulously to formulate this market research report. The use of proven tools such as SWOT analysis and Porter's Five Forces analysis is very useful in creating a superior Europe Digital Payment Market report.

The worldwide Europe Digital Payment Market business report examines the market by region, especially North America, China, Europe, Southeast Asia, Japan, and India, focusing on the leading manufacturers in the global market, with respect to production, price, revenue and market share for every manufacturer. This is useful for knowing the general conditions prevailing in the market, the market and competitors' pricing strategies. Some of the prominent features used while creating this market research report include the highest level of passion, practical solutions, committed research and analysis, modernism, integrated approach, and latest technology. To get detailed Europe Digital Payment Market reports, request an analyst call or submit an inquiry any time.

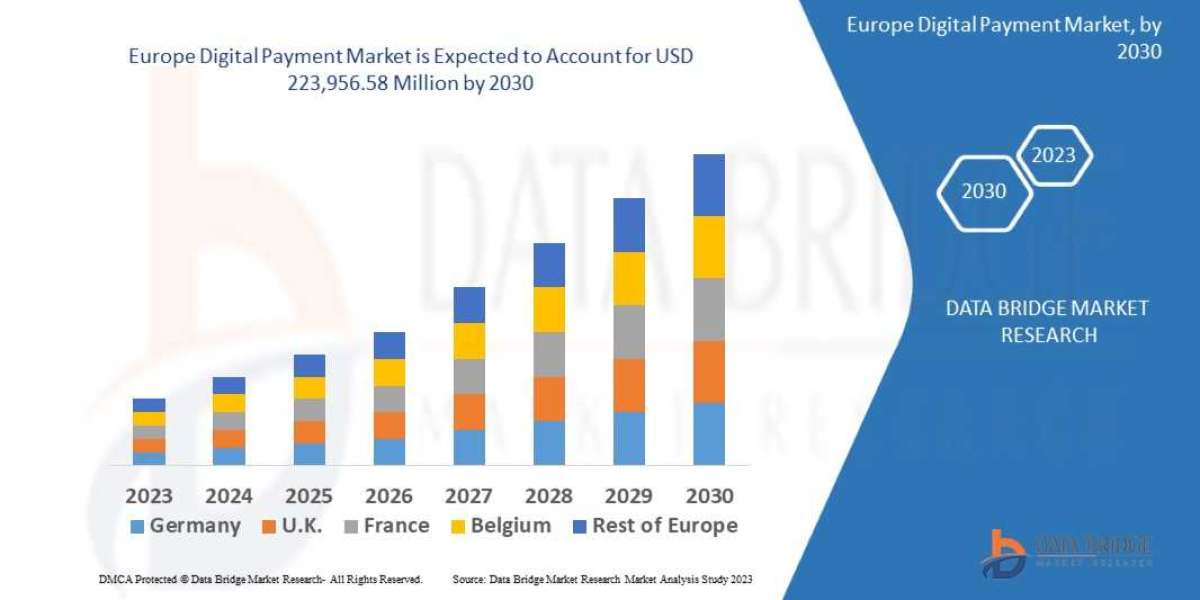

Data Bridge Market Research analyses that the digital payment market is expected to reach USD 223,956.58 million by 2030, which is USD 56,827.44 million in 2022, at a CAGR of 18.70% during the forecast period.

Explore Further Details about This Research Europe Digital Payment Market Report https://www.databridgemarketresearch.com/reports/europe-digital-payment-market

Europe Digital Payment Market Scope and Segmentation

REPORT METRIC | DETAILS |

Forecast Period | 2023 to 2030 |

Base Year | 2022 |

Historic Years | 2021 (Customizable to 2015 - 2020) |

Quantitative Units | Revenue in USD Million, Volumes in Units, Pricing in USD |

Segments Covered | Offering (Solutions, Services), Deployment Model (On Premises, Cloud), Organization Size (Large Enterprises, Small and Medium Enterprises (SMEs)), Mode of Payment (Payment Cards, Point of Sale, Unified Payments Interface (UPI) Service, Mobile Payment, Online Payment), Mode of Usage (Mobile Application, Desktop/Web Browser), Technology (Application Programming Interface (API), Data Analytics and Machine Learning, Digital Ledger Technology (DLT), Artificial Intelligence and Internet of Things, Biometric Authentication), Use Case (Person (P/C), Merchant/ Business, Government), End User (Commercial, Consumer) |

Countries Covered | Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe |

Market Players Covered | ACI Worldwide (U.S.), PayPal, Inc. (U.S.), Novatti Group Limited (Australia), Global Payments Inc. (U.S.), Visa (U.S.), Stripe, Inc. (Ireland), Google, LLC (U.S.), Finastra. (U.K.), SAMSUNG (South Korea), Amazon Web Services, Inc. (U.S.), Financial Software Systems Pvt. Ltd. (U.S.), Aurus Inc. (U.S.), Adyen (Netherlands), Apple Inc. (U.S.), Fiserv, Inc. (U.S.), WEX Inc. (U.S.), wirecard (U.S.), Mastercard. (U.S.) among many others. |

Market Opportunities |

|

Market Definition

Digital payment, sometimes named an electronic payment, is the transfer of money from one payment account to another payment account by using a digital device such as a computer, mobile phone, Point of Sales (POS) or a digital channel communications such as Society for the Worldwide Interbank Financial Telecommunication (SWIFT) or mobile wireless data. This definition includes payments made with mobile money, bank transfers, and payment cards including debit, credit and prepaid cards.

Europe Digital Payment Market

Drivers

- Growth and expansion of e-commerce

Growth and expansion of e-commerce has contributed to a surge in the digital financial services associated with consumers and small businesses which is boosting the growth of the digital payment market. For instance, many e-commerce platforms are seeing surge in the usage of digital payments, mainly digital wallet which is a digital payment system for helping the consumers with instant and safe transactions. Therefore, the growth and expansion of e-commerce is likely to drive the market growth.

- Increasing demand of digital payment in banking, financial services and insurance (BFSI) sector

Banking, financial services and insurance (BFSI) sector is the dominant sector which is anticipated to have the major impact on the digital payment market. In last few years, insurance, financial services, and stockbroking businesses have witnessed a huge change in the way they receive and disburse funds. Therefore, surge in demand for digital payment for cross-border and domestic transactions in banking, financial services and insurance (BFSI) sector is expected to boost the market growth.

Opportunities

- Increasing efforts by bank to launch European payment initiative

Banks in Europe are making several efforts to introduced European payment initiative which aimed at generating unified payments solution for consumers and sellers across this region. Such initiatives are anticipated to generate lucrative opportunities for the growth of the market during the forecast period.

- Rapid growth in smartphone users

A rapid growth in smartphone users in developing region of Europe, making the digital payment process user-friendly and more convenient option. Business outlets highly opting to adapt with mobile-based payment applications such as Pay Pal, Apple Pay, Google pay, Phone May, Amazon pay, and many other. Hence, the growth in smartphone users will likely to create ample opportunities for the market growth.

Key Offerings:

- Past Market Size and Competitive Landscape (2018 to 2022)

- Past Pricing and price curve by region (2018 to 2022)

- Market Size, Share, Size Forecast by different segment | 2023−2029

- Market Dynamics – Growth Drivers, Restraints, Opportunities, and Key Trends by Region

- Market Segmentation – A detailed analysis by segment with their sub-segments and Region

- Competitive Landscape – Profiles of selected key players by region from a strategic perspective

- Competitive landscape – Europe Digital Payment Market Leaders, Market Followers, Regional player

- Competitive benchmarking of key players by region

- PESTLE Analysis

- PORTER’s analysis

- Value chain and supply chain analysis

- Legal Aspects of Business by Region

- Lucrative business opportunities with SWOT analysis

- Recommendations

Browse Related Reports:

Peripartum cardiomyopathy Market Size, Share, Growth | Opportunities,

Europe Bone Densitometer Devices Market Size, Share Analysis Report

Polysaccharides and Oligosaccharides Market Size, Share, Growth Analysis

Molecular Cytogenetic Systems Market Size, Share, Growth

Point-to-Point (P2P) Antennas Market Size, Share Trends: Report

Human granulocytic ehrlichiosis Market Size, Share, Industry, Forecast

Racing Games Market Size, Share Trends [Report]

About Data Bridge Market Research:

US: +1 888 387 2818

UK: +44 208 089 1725

Hong Kong: +852 8192 7475

Email – corporatesales@databridgemarketresearch.com

"